Gran Tierra Energy Inc. (GTE), an oil and gas exploration and production company operating in Colombia and Ecuador, has garnered attention in recent years.

In this article, we will be discussing GTE’s past stock performance and provide insights into its short-term, mid-term, and long-term GTE stock forecast.

Highlights

- Our analysis shows that GTE is a high-risk medium reward stock that can give about 7-15% returns in the medium run.

- Announced Reverse Stock splits which are considered a positive sign for the company

- By 2030, our analysis suggests that Gran Tierra Energy’s stock price could reach a maximum of $6.15, with an average price of $4.9

Understanding Gran Tierra Energy

Gran Tierra Energy Inc. is an established player in the oil and gas industry, specializing in exploration and production activities. The company went public in 2007 with an initial public offering (IPO) price of $10 per share.

Initially, the stock price experienced steady growth, reaching its peak at $7.87 per share in 2012.

However, the following years were challenging for GTE as its stock price declined, hitting a low of $0.69 per share in December 2019.

The stock price of Gran Tierra Energy has been subject to significant volatility and fluctuations over the years. Factors such as oil price volatility and the company’s operations in politically and economically unstable regions have contributed to this volatility.

In 2020, the COVID-19 pandemic and the subsequent drop in oil prices further impacted GTE’s stock price. The price plunged to as low as $0.22 per share in March 2020 before recovering to around $0.50 per share by the end of the year.

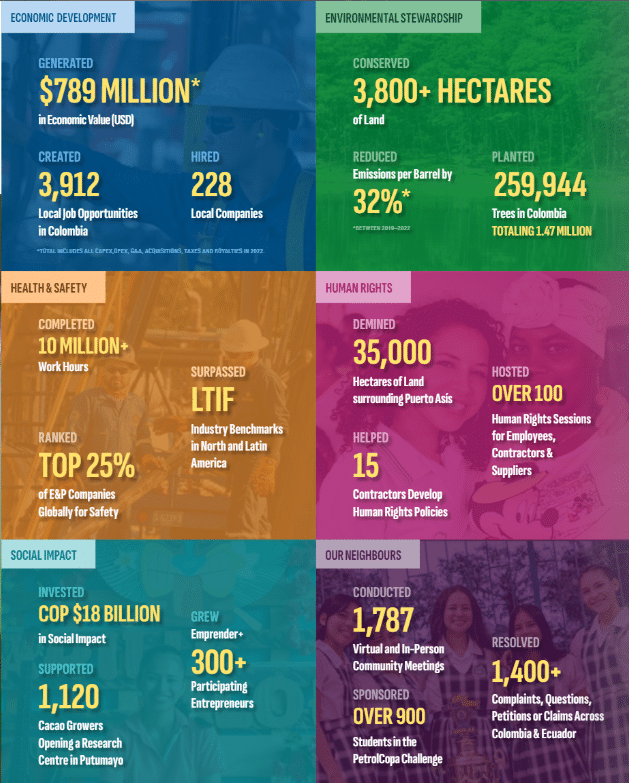

Post that they have been doing pretty well as far as all the verticals they are involved in. This is their 2022 performance as per the Investor presentation.

Latest News About Gran Tierra Energy Inc.

- Gran Tierra Energy has reported an upward trend in production during the latter half of the second quarter of 2023. The company has successfully brought online newly drilled oil wells, including Acordionero, Costayaco, and Moqueta.

- This ramp-up in production reflects Gran Tierra’s focus on oil and natural gas exploration and production in Colombia and Ecuador. The steady increase in production indicates the company’s efforts to maximize its output and capitalize on its oil assets.

- Gran Tierra Energy Inc. has announced a reverse stock split. A reverse stock split is a strategic move that involves reducing the number of outstanding shares while increasing the share price proportionally.

- This action is often taken to boost the share price and meet specific listing requirements or to enhance the company’s perception of the market. The reverse stock split demonstrates Gran Tierra’s commitment to optimizing its capital structure and potentially attracting new investors.

- In the second quarter of 2023, Gran Tierra Energy achieved an average production rate of approximately 33,600 barrels of oil per day (BOPD). This represents a 6% increase compared to the first quarter of the same year.

- The growth in average production indicates the company’s operational efficiency and successful execution of its drilling and production activities. Gran Tierra’s ability to sustain and enhance its production levels positions the company for continued success in the oil and gas industry.

GTE Stock Forecast from 2023 to 2030

Here

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2023 | $0.61 | $0.94 | $1.27 |

| 2024 | $0.67 | $1.04 | $1.96 |

| 2025 | $0.82 | $1.43 | $2.69 |

| 2026 | $1.39 | $2.45 | $3.78 |

| 2027 | $1.77 | $2.62 | $3.5 |

| 2030 | $3.25 | $4.9 | $6.15 |

GTE Stock Forecast 2023

If the market does well, the value of GTE stock could go up again this year! Our GTE Stock Forecast 2023 tells us that the overall performance of GTE stock will be strong. We’ve looked at a lot of things like how the company is doing, what the market is like right now, and other technical details.

As per our GTE Stock Forecast 2023, we think that GTE stock might reach a maximum price of $1.27 in 2023, but it won’t go lower than $0.61. On average, we estimate that the stock will cost around $0.94 in 2023.

GTE Stock Forecast 2024

Looking ahead, our GTE Stock Forecast predicts a positive outlook for Gran Tierra Energy’s stock price in the coming years. In 2024, we expect the stock to reach a minimum price of $0.67 and a maximum price of $1.96. The average price is projected to be around $1.04.

GTE Stock Forecast 2025

By 2025, we anticipate further growth in the stock’s value, with a minimum price of $0.82, a maximum price of $2.69, and an average price of approximately $1.43.

GTE Stock Forecast 2026

For the years 2026 and 2027, our GTE Stock Forecast indicates a positive trend continuing. The stock is expected to have a minimum price of $1.39 and a maximum price of $3.78 in 2026, with an average price of $2.45.

GTE Stock Forecast 2027

In 2027, the stock’s value is projected to range from a minimum of $1.77 to a maximum of $3.5, with an average price of approximately $2.62.

GTE Stock Forecast 2030

Looking further ahead to 2030, our analysis suggests that Gran Tierra Energy’s stock price could reach a maximum of $6.15, with an average price of $4.9.

Is GTE Stock a Good Investment?

As per our analysis, GTE is considered a high-risk and medium-return stock. It operates in the oil and gas exploration and production industry, which is vulnerable to fluctuations in commodity prices.

Additionally, the company’s operations primarily focus on politically and economically unstable regions. Therefore, investing in GTE stock entails higher risks. It’s essential for investors to thoroughly research and assess their own risk tolerance before making any investment decisions.

Also Read:

- GESI Stock Forecast

- Robinhood Stock Forecast

- RIOT Stock Forecast

- MARA Stock Forecast

- Lucid Price Prediction

Why Invest in Gran Tierra Energy (GTE)

- Gran Tierra Energy currently has a net debt (1) of less than $500 million. In 2023, the company repurchased $6.8 million worth of bonds and 13 million shares, demonstrating its efforts to reduce debt and improve its financial position.

- The company’s forecast for fiscal year 2023 indicates a projected free cash flow of approximately $135 million before exploration costs and $65 million after exploration costs. This indicates the potential for positive cash generation and financial stability in the coming year.

- Gran Tierra Energy’s stock is currently trading at a significant discount compared to its 1P and 2P Before Tax Net Asset Value per share, which are valued at $47.63 (1P) and $76.05 (2P) respectively.

- This suggests that the company’s stock may be undervalued, presenting a potential investment opportunity for investors looking to capitalize on the company’s underlying asset value.

Note: (1) and (2P) refers to the classification of Net Asset Value per share based on proven reserves (1P) and proven plus probable reserves (2P) before tax.

Frequently Asked Questions

Does GTE stock pay dividends?

Gran Tierra Energy Inc. does not currently pay dividends. Dividend payments are dependent on the company’s financial performance, cash flow, and management’s decision to distribute profits to shareholders.

As of now, GTE has not paid a dividend within the past 12 months.

Where will GTE stock be in 2030?

Based on our detailed fundamental analysis, GTE stock is predicted to have a first target price of around $6 in 2030, while the second target price is estimated to be around $4. However, it’s crucial to note that these projections are subject to change and may vary based on future market conditions and the company’s performance.

What is GTE’s stock price forecast for 2025?

As per their latest operational report presented in May 2023, they have Drilled 19 Development Wells, Consisting of 12 New Producers and 7 New Injectors. So overall looking promising for the next couple of years.

And according to our analysis, the maximum price target for GTE stock in 2025 is projected to be $2.69, while the average trading price is expected to be around $1.43.

What is GTE’s stock price forecast for 2023?

As per our GTE stock forecast for 2023, the maximum price GTE can reach is projected to be $1.27, while the average trading price is estimated to be around $0.97.

Is GTE stock a buy?

The stock has been down over the past year and it is currently sitting at a good market valuation for an entry. Overall a positive signal for the buy.

Should I buy Gran Tierra Energy?

There is some positive growth expected as per their latest operational report. On the financial side, Gran Tierra Energy currently has a net debt (1) of less than $500 million. In 2023, the company repurchased $6.8 million worth of bonds and 13 million shares. After the recent market downtrend, it is sitting at a very attractive valuation right now.

You may check some more reasons why you should buy it here.

Final Take

Gran Tierra Energy’s stock price has shown volatility in the past, and its future performance is subject to various factors, including oil prices, geopolitical situations, and company-specific developments. However, they are significantly down from their all-time highs and that makes the valuation attractive. Considering the Ukraine-Russia war comes to a conclusion soon it should give a positive signal for an uptrend in the stock.

Disclaimer - Please note that these predictions and analyses are for informational purposes only. We recommend our readers conduct in-depth research before investing in any stock and follow risk management techniques due to the volatile nature of the stock market.