Marathon Digital Holdings(MARA) is a digital asset technology company that is aiming to become a leading and environmentally sustainable Bitcoin mining enterprise in North America.

In this article, we will look at various aspects of the company and do MARA Price Predictions for 2023, 2025, and beyond. We will also look at what the future holds for MARA.

Highlights

- During the last quarter, Marathon significantly improved its financial position by increasing its cash position by $12 million and reducing its debt by $50 million.

- MARA has expanded its unrestricted Bitcoin holdings by 3,132 Bitcoin.

- Based on the analysis, we anticipate the stock to cross the $15 range by the year 2025.

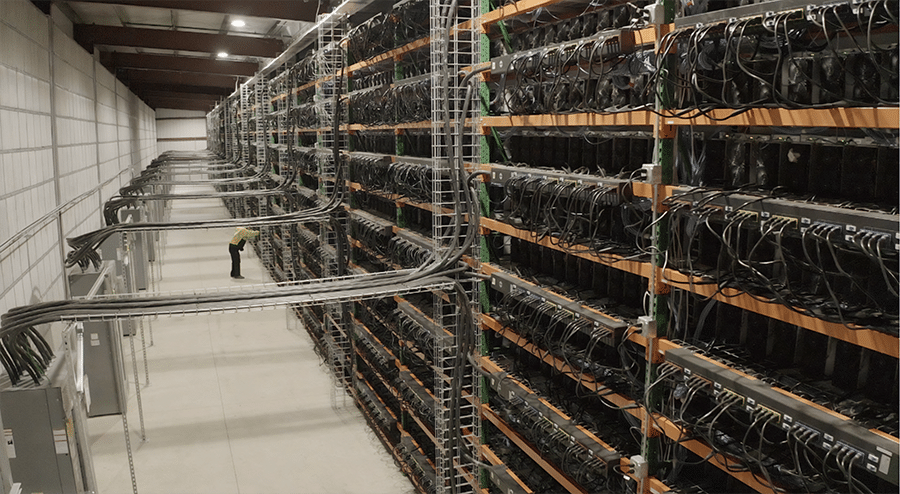

- As of June 1, Marathon Digital had an operating fleet of around 133, 600 Bitcoin miners capable of producing 15.2 EH/s. And they are planning to increase it to 23EH/s by the middle of this year.

Understanding Marathon Digital Holdings (MARA)

Marathon is a leading Bitcoin company with a primary mission to enhance the Bitcoin network by sustainably increasing its computational power, also known as the “hash rate.”

By focusing on innovation, sustainability, and diversification, Marathon sets itself apart in the Bitcoin mining industry.

In this article, we will explore Marathon’s building blocks and the strategies that make it a key player in the world of cryptocurrency.

Some specific areas make MARA unique and set it apart from other Bitcoin mining companies like RIOT.

Vertically Integrated Technology

Marathon stands out in the Bitcoin mining industry by vertically integrating the Bitcoin mining technology stack. This means that they control or influence every aspect of the mining process, from the mining pool to the ASIC.

1.1 MaraPool: Operating our Own Mining Pool

Marathon operates its mining pool called “MaraPool.” By having control over the mining pool, Marathon can optimize the mining process and maximize efficiency.

This allows them to stay ahead of the competition and contribute to the overall security of the Bitcoin network.

1.2 Custom Firmware and Hardware Investment

To further improve efficiency and innovation, Marathon develops custom firmware for its mining equipment. They also invest in cutting-edge hardware technology to ensure they have access to the latest advancements in the field. By controlling these aspects, Marathon can fine-tune its operations and achieve higher performance levels.

1.3 Infrastructure Design: Immersion Cooling Systems

Marathon’s commitment to technological innovation extends to the design of its infrastructure. They have pioneered the use of immersion cooling systems, which involve submerging mining equipment in a non-conductive liquid to dissipate heat more efficiently. This cooling method increases energy efficiency and prolongs the lifespan of the mining equipment.

Bitcoin Treasury

Marathon understands the long-term value of Bitcoin as a digital asset. As part of their corporate treasury strategy, Marathon holds a significant amount of Bitcoin, making them one of the largest holders among publicly traded companies in the United States.

This strategic approach allows Marathon to benefit from the potential future appreciation of Bitcoin’s value while also reinvesting in its operations.

Diversified Operations

In line with the principles of traditional investment portfolios, Marathon maintains a diversified approach to its operations. They have mining operations in multiple countries and states, ensuring geographical diversification.

Marathon also adapts its strategies and business models based on the market conditions and opportunities available. This includes leveraging partnerships with third-party hosting providers or self-hosting their mining operations.

Sustainable Energy

Marathon is committed to sustainable practices in Bitcoin mining. They actively seek out locations near sustainable sources of energy, such as wind, solar, hydro, nuclear, and biofuel.

By deploying their miners near these sources, Marathon contributes to the viability of renewable projects and helps stabilize power grids in the regions where they operate.

Latest News About MARA

- In May, Marathon, a company in the Bitcoin mining industry, achieved a new record by producing 1,245 bitcoins. This increase was driven by a higher hash rate and a significant rise in transaction fees, which made up around 11.8% of their total Bitcoin earnings. Marathon believes that the emergence of Ordinals and the unusually high transaction fees in May are promising indicators for the future of mining economics.

- During the last quarter, Marathon significantly improved its financial position by increasing its cash position by $12 million, reducing its debt by $50 million, and expanding its unrestricted bitcoin holdings by 3,132 bitcoin through prepayment of their term loan and termination of credit facilities with Silvergate Bank. They ended the quarter with approximately $124.9 million in unrestricted cash and cash equivalents, along with 11,466 bitcoins valued at around $326.5 million.

- With upcoming increases in hash rate, Marathon remains confident in achieving their target of reaching 23 exahash by mid-year. They maintain an optimistic outlook for accomplishing their primary growth objectives and positioning themselves as a leading, energy-efficient, and technologically advanced global Bitcoin mining operation.

MARA Technical Analysis – July 1, 2025

- Mara is currently in a consolidation phase, with significant consolidation around the $9.5 range.

- The stock’s direction is uncertain, as it could break out in either direction.

- If the stock breaks out on the upside, there is potential for it to reach up to $15.

- However, if the support at the Dollar Tree level is broken, the stock could decline to around $3.

- The RSI (Relative Strength Index) is between 40 to 50, indicating consolidation and the possibility of the stock going in either direction.

- Monitoring the performance of Bitcoin is crucial, as it will likely impact the price action of MARA.

MARA Price Prediction from 2023 to 2030

Based on the long-term forecast, here is a quick view of the MARA price prediction for the coming years.

| Year | Min | Avg | Max |

|---|---|---|---|

| 2023 | 9.37 | 10.75 | 12.11 |

| 2024 | 11.18 | 12.32 | 13.46 |

| 2025 | 12.07 | 13.35 | 14.53 |

| 2026 | 11.03 | 13.23 | 15.43 |

| 2027 | 12.80 | 14.57 | 16.34 |

| 2028 | 13.83 | 15.95 | 17.67 |

| 2029 | 16.43 | 18.29 | 20.15 |

| 2030 | 19.48 | 21.19 | 23.90 |

MARA Price Prediction 2024

Looking ahead, our MARA Stock Prediction indicates a positive outlook for Marathon Digital’s stock price in the coming year.

In 2024, we expect the stock to reach a minimum price of $11.18 and a maximum price of $13.46. The average price is projected to be around $12.32.

MARA Price Prediction 2025

If crypto specifically bitcoin prices are on an upward trajectory then that would be a big plus sign for MARA, our MARA Stock Forecast presents an optimistic outlook for the future price of Marathon Digital.

In the year 2025, we anticipate the stock to fluctuate between a minimum of $14 and a maximum of $20.05 with an average projected price of approximately $18

MARA Price Prediction 2026

In 2026, we expect the stock to reach a minimum price of $11.03 and a maximum price of $15.43. The average price is projected to be around $13.23.

MARA Price Prediction 2030

In 2030, we expect the stock to reach a minimum price of $19.48 and a maximum price of $23.90. The average price is projected to be around $21.19.

This is only based on what indicators we see right now however as we expect volatility to play a major role in the crypto industry we could see it go much higher if bitcoin prices go back to their all-time highs again in the next 5 years.

Is MARA Stock a Good Investment?

MARA, being primarily a Bitcoin mining company, relies on their ability to mine Bitcoins for revenue. According to their latest report, they have shown significant improvement in their financials, with a $12 million increase in their cash position and a $15 million reduction in debt.

Considering the current upward trajectory of the crypto market in 2023, which contrasts with the market downturn in 2022, this bodes well for MARA as the value of the Bitcoins they mine would likely increase.

Also, Bitcoin holds the top position among cryptocurrencies and appears to be leading in the long term. Investing in MARA provides an indirect way to have exposure to the crypto market without directly purchasing Bitcoin or other cryptocurrencies.

One aspect that MARA probably will have to improve upon is diversification. The other mining players like HUT8 have diversified their verticals to not solely depend on Bitcoin mining. A similar approach would really set up MARA to balance their portfolio.

Considering these factors, it can be concluded that MARA is a good investment option, especially for those seeking to have a portion of their portfolio invested in the crypto market.

Also Read:

What is the future of MARA?

The future of MARA is heavily reliant on the overall performance of the cryptocurrency market. Given that MARA is primarily involved in Bitcoin mining, its prospects are closely tied to the rate of crypto adoption across various industries.

The increasing adoption of cryptocurrencies, driven by the introduction of metaverses, NFTs, gaming, and AI applications, presents a significant opportunity for MARA as Bitcoin transactions are likely to be the primary beneficiaries.

As the leading Bitcoin mining company, MARA stands to benefit from the growing adoption of crypto, which is expected to translate into increased mining activity. Notably, MARA has demonstrated positive momentum by expanding their Bitcoin holdings by approximately 3,132 Bitcoins, as reported in their latest quarterly results for Q1 2023. They are also committed to expanding their hash rate and investing in technological advancements, positioning themselves for future growth.

Considering these factors, the future of MARA appears bright, especially in the medium to long term.

Frequently Asked Questions

What is the price prediction for MARA in 2030?

In 2030, we expect the stock to reach a minimum price of $19.48 and a maximum price of $23.90. The average price is projected to be around $21.19.

Is MARA a good stock to buy?

Mara stands as one of the prominent Bitcoin mining companies in the North American market. If you have faith in the future of cryptocurrency adoption, Mara presents an excellent investment opportunity at its current level.

With its current consolidation phase, Mara has the potential to break out at any given moment, contingent upon the performance of Bitcoin.

What is the 5 year prediction for MARA?

Based on our comprehensive technical and financial analysis, it appears that the company is in a favorable financial position for the next five years.

Given the anticipated upward trajectory of the Bitcoin and crypto market, we expect Mara to surpass the $15 or $16 mark during this timeframe.

Final Take

As one of the largest mining companies in the US, MARA has a promising future prospect. With the potential for higher crypto trends in the coming years, MARA is well-positioned to be one of the beneficiaries of the crypto mining industry.

In last couple of weeks bitcoin prices broke out of 30k mark which is a substantial mental resistance point and if it can sustain this for a while then we could see new highs very quickly.

This will have a direct positive impact on MARA share prices and it will follow the bitcoin pattern and can see its year highs as well. So watch out for a break out coming very soon.

We hope that this analysis has provided you with a better understanding of MARA’s price prediction and its potential for growth in the future.

Disclaimer - Please note that these predictions and analyses are for informational purposes only. We recommend our readers conduct in-depth research before investing in any stock and follow risk management techniques due to the volatile nature of the stock market.