Hut 8 Mining Corp. is a cryptocurrency mining company that operates in North America. Its primary business involves providing computing power to mining pools in exchange for digital assets.

In this article, we are going to analyze the HUT price prediction for upcoming years. We will look at the technical chart and check the latest development to see if this would be a good investment opportunity.

Highlights

- Hut 8 Mining Corp. and US Bitcoin Corp. have agreed to merge into a new company called Hut 8 Corp.

- In Q1 2023, Hut 8’s HPC operations generated $4.5 million in revenue, primarily from monthly recurring sources. This represents an increase from the $3.3 million generated in Q1 2022

- By the year 2030, we expect HUT to cross $25 USD in value.

Understanding HUT 8 Mining (HUT)

Hut 8 Mining Corp. is a company that specializes in mining Bitcoin and building blockchain infrastructure.

It offers investors a straightforward way to participate in Bitcoin by removing the technical complexities and limitations associated with buying the actual cryptocurrency.

Andrew Kiguel founded the company on June 9, 2011, and its headquarters are located in Toronto, Canada.

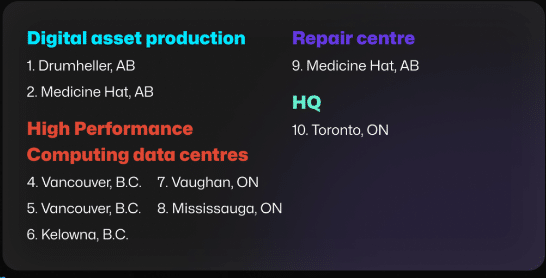

They have three digital asset mining facilities and five High-Performance Computing data centers located across Canada.

Revenue Streams for HUT 8 Mining Corp

Unlike the other big Bitcoin mining players like MARA and RIOT, the revenue stream is quite diversified for HUT8. Here are the main three streams in how their revenue is generated.

Digital Asset Mining:

Hut 8 Mining Corp generates revenue through digital asset mining. The company has contracts with mining pools where it provides computing power in exchange for digital assets, mainly Bitcoin.

Revenue is recognized when the company receives Bitcoin at the fair market value based on the closing price listed on Coinmarketcap. Any difference between the fair value of the received digital assets and the realized price upon disposal is recorded as a gain or loss.

Hosting

Another revenue stream for Hut 8 comes from hosting contracts. The company operates mining equipment on behalf of third parties within its facilities. Revenue from hosting contracts is recognized over time as Hut 8 fulfills its obligation of operating the hosted equipment.

This means that revenue is recognized gradually as the equipment is used and maintained for the agreed-upon duration of the contracts.

High-Performance Computing

Hut 8 also earns revenue through its high-performance computing business, which offers cloud and colocation services to clients. Revenue from these services is measured at the fair value of the consideration received, taking into account discounts and sales taxes.

Revenue is recognized as the company providing related services to its customers. The revenue recognition for high-performance computing services follows the five-step IFRS 15 Revenue from Contracts with Customers model, ensuring the appropriate treatment of this revenue source.

Latest Updates on HUT

- Hut 8 Mining Corp. and US Bitcoin Corp. have agreed to merge into a new company called Hut 8 Corp. Hut 8 shareholders will receive 0.2 shares of the new company for each Hut 8 share, while USBTC shareholders will receive 0.6716 shares of the new company for each USBTC share.

- After the merger, Hut 8 shareholders will own about 50% of the new company, and USBTC shareholders will own the other 50%.

- The company experienced a decrease in revenue, which dropped to $19.0 million in Q1 2023 from $53.3 million in Q1 2022. This decline can be attributed to various factors.

- Hut 8 mined 475 Bitcoin during Q1 2023, marking a significant 50% decrease compared to Q1 2022. This decline was primarily caused by two factors. Firstly, there was an increase in the average Bitcoin network difficulty, which made mining more challenging and resulted in fewer Bitcoins being mined.

- Secondly, the company faced ongoing electrical issues at its Drumheller facility. These issues, which began in Q4 2022, continued to impact operations and significantly reduced mining activities at the facility.

- Hut 8 expects complete restoration at the Drumheller site within the next 10 to 12 weeks.

- In Q1 2023, Hut 8’s HPC operations generated $4.5 million in revenue, primarily from monthly recurring sources. This represents an increase from the $3.3 million generated in Q1 2022 when Hut 8 acquired the HPC operations on January 31, 2022.

- As of March 31, 2023, Hut 8’s installed hashrate stood at 2.6 EH/s (excluding the North Bay facility). This reflects a slight increase from the hash rate recorded on December 31, 2022. Additionally, during Q1 2023, 988 miners previously located at the North Bay facility were successfully energized at the Medicine Hat facility.

HUT Technical Analysis – March 9, 2026

- Hut Mining’s technical chart shows a significant level of support at $2.5 USD, indicating that the stock has consistently found buyers at this price point.

- The price action on the chart suggests the formation of an ascending triangle pattern, which is considered a bullish pattern. This pattern is characterized by higher swing lows connected by a rising trendline, indicating potential upward momentum.

- The narrowing of the triangle pattern suggests that a breakout is likely to occur in the near future. As the price consolidates within the triangle, it creates a coiling effect, often preceding a significant price move.

- Decent volumes accompanying the price movement further support the bullish outlook, indicating active participation and interest from market participants.

- However, it’s worth noting that the Relative Strength Index (RSI), a momentum oscillator, is currently above 60. This indicates that the stock may be overbought and could potentially experience a cooling-off period before resuming its upward movement. A desirable entry point for traders could be when the RSI drops to around the 50 range.

- It’s important to consider recent developments, such as Hut Mining’s merger with US Bitcoin Mining Corp, which adds to the positive future prospects of the company. This merger could potentially lead to enhanced operational capabilities and growth opportunities.

HUT Price Prediction from 2023 to 2030

Based on the long-term forecast, here is a quick view of the HUT price prediction for the coming years. Please note that all the prices here are represented in USD.

| Year | Min | Avg | Max |

|---|---|---|---|

| 2023 | $2.10 | $2.95 | $3.80 |

| 2024 | $2.40 | $2.85 | $3.90 |

| 2025 | $3.85 | $4.25 | $4.65 |

| 2026 | $5.10 | $5.65 | $6.20 |

| 2027 | $8.90 | $9.50 | $10.10 |

| 2028 | $13.05 | $13.80 | $14.55 |

| 2029 | $18.90 | $19.75 | $20.60 |

| 2030 | $27.50 | $28.65 | $29.80 |

HUT Price Prediction 2023

In 2023, the price of HUT is predicted to range from a minimum of $2.10 to an average of $2.95, with a maximum of $3.80. This indicates a positive trend, as the prices continue to rise gradually over time. Investors can expect stability and potential growth in HUT’s value during this year.

HUT Price Prediction 2024

In 2024, the price of HUT is predicted to range from a minimum of $2.40 to an average of $2.85, with a maximum of $3.30. As HUT would be recovering from their recent data center issues this year could be a consolidation phase for them.

HUT Price Prediction 2025

Looking ahead to 2025, the price of HUT is anticipated to experience further upward movement. The projected prices suggest a minimum of $3.85, an average of $4.25, and a maximum of $4.65.

We should a much higher trend for 2025 as the crypto and specifically the bitcoin is expected to do pretty well in 2025.

HUT Price Prediction 2026

The year 2026 holds promising prospects for HUT, as the predicted prices show a continued upward trajectory. Investors can anticipate a minimum price of $5.10, an average of $5.65, and a maximum of $6.20. These figures indicate growing confidence in the cryptocurrency, potentially attracting more attention from investors and traders.

HUT Price Prediction 2027

By 2027, HUT’s value is expected to maintain its positive momentum. The projected prices suggest a minimum of $8.90, an average of $9.50, and a maximum of $10.10. This demonstrates a significant increase compared to previous years, signifying potential growth opportunities for investors.

HUT Price Prediction 2030

In 2030, HUT’s value is expected to continue its upward trend. The projected prices indicate a minimum of $27.50, an average of $28.65, and a maximum of $29.80. These figures illustrate significant growth potential for HUT, potentially attracting more attention and investment in the coming years.

This is assuming that crypto adoption will see a higher trend in the coming decade however if there is a decline in crypto sentiment overall then that would negatively impact all mining companies as well including HUT8.

Is HUT Stock a Good Investment?

Based on our observation of the mining industry and the efforts made by HUT 8 to diversify their income streams, it is evident that they are moving beyond sole reliance on Bitcoin. This signifies a positive development and presents a promising investment opportunity.

If you are seeking to diversify your portfolio and allocate a portion towards cryptocurrencies, investing in HUT 8 can serve as an alternative and favorable approach. It allows you to indirectly invest in the crypto market, offering a potential avenue to enhance your portfolio’s performance.

Also Read:

Frequently Asked Questions

What is the price prediction for HUT 8 in 2023?

In 2023, the price of HUT is predicted to range from a minimum of $2.10 to an average of $2.95, with a maximum of $3.80.

Is HUT a good buy now?

Yes based on technical analysis HUT appears to be a having a good entry point as of now. The price action on the chart suggests the formation of an ascending triangle pattern, which is considered a bullish pattern.

So long as this pattern holds we can expect a big move upwards soon.

How high will HUT stock go?

Based on our long-term forecast HUT is expected to be around $30 by the year 2030. This assumes that positive crypto sentiment and adoption continues in upcoming years.

Final Take

Overall we can say that HUT8 Mining does have a good future prospect for growth and with their recent merger they are looking solid in terms of their mining foothold.

It is also a good candidate if you want to start trading some options as its almost at its lowest levels.

With the bitcoin prices soaring in last of weeks the overall cryptocurrency trend appears to be coming back from its last year suboptimal performance.

And If the crypto market tends to have a good sentiment overall going forward then HUT price prediction may go even higher than this.

Disclaimer - Please note that these predictions and analyses are for informational purposes only. We recommend our readers conduct in-depth research before investing in any stock and follow risk management techniques due to the volatile nature of the stock market.